Services Provided to Investors

- Execution of trades on behalf of investors.

- Issuance of Contract Notes.

- Settlement of client’s funds.

- Issuance of retention statement of funds.

- Information sharing with the client w.r.t. exchange circulars.

- Redressal of Investor’s grievances.

- Issuance of intimations regarding margin due payments.

- Facilitate execution of early pay-in obligation instructions.

- Risk management systems to mitigate operational and market risk.

- Facilitate client profile changes in the system as instructed by the client.

- Intimation of securities held in Client Unpaid Securities Account (CUSA) Account.

Rights of Investors

- Ask for and receive information from a firm about the work history and background of the person handling your account, as well as information about the firm itself.

- Receive complete information about the risks, obligations, and costs of any investment before investing.

- Receive recommendations consistent with your financial needs and investment objectives.

- Discuss your grievances with compliance officer of the firm and receive prompt attention to and fair consideration of your concerns.

- Receive a copy of all completed account forms and agreements.

- Receive account statements that are accurate and understandable.

- Access your funds in a timely manner and receive information about any restrictions or limitations on access.

- Receive complete information about maintenance or service charges, transaction or redemption fees, and penalties.

- Understand the terms and conditions of transactions you undertake.

Various activities of Stock Brokers with timelines

| Sr. No. | Activities | Expected Timelines |

|---|---|---|

| 1 | KYC entered into KRA System and CKYCR | 10 days of account opening |

| 2 | Client Onboarding | Immediate, but not later than one week |

| 3 | Order execution | Immediate on receipt of order, but not later than the same day |

| 4 | Allocation of Unique Client Code | Before trading |

| 5 | Copy of duly completed Client Registration Documents to clients | 7 days from the date of upload of Unique Client Code to the Exchange by the trading member |

| 6 | Issuance of contract notes | 24 hours of execution of trades |

| 7 | Collection of upfront margin from client | Before initiation of trade |

| 8 | Issuance of intimations regarding other margin due payments | At the end of the T day |

| 9 | Settlement of client funds | 30 days / 90 days for running account settlement (RAS) as per the preference of client. |

| 10 | ‘Statement of Accounts’ for Funds, Securities and Commodities | Weekly basis (Within four trading days of following week) |

| 11 | Issuance of retention statement of funds/commodities | 5 days from the date of settlement |

| 12 | Issuance of Annual Global Statement | 30 days from the end of the financial year |

| 13 | Investor grievances redressal | 30 days from the receipt of the complaint |

DOs and DON’Ts for Investors

| Sr. No. | DOs | DON’Ts |

|---|---|---|

| 1 | Read all documents and conditions being agreed before signing the account opening form. | Do not deal with unregistered stock broker. |

| 2 | Receive a copy of KYC, copy of account opening documents and Unique Client Code. | Do not forget to strike off blanks in your account opening and KYC. |

| 3 | Read the product / operational framework / timelines related to various Trading and Clearing & Settlement processes. | Do not submit an incomplete account opening and KYC form. |

| 4 | Receive all information about brokerage, fees and other charges levied. | Do not forget to inform any change in information linked to trading account and obtain confirmation of updation in the system. |

| 5 | Register your mobile number and email ID in your trading, demat and bank accounts to get regular alerts on your transactions. | Do not transfer funds, for the purposes of trading to anyone other than a stock broker. No payment should be made in name of employee of stock broker. |

| 6 | If executed, receive a copy of Power of Attorney. However, Power of Attorney is not a mandatory requirement as per SEBI / Stock Exchanges. Before granting Power of Attorney, carefully examine the scope and implications of powers being granted. | Do not ignore any emails / SMSs received with regards to trades done, from the Stock Exchange and raise a concern, if discrepancy is observed. |

| 7 | Receive contract notes for trades executed, showing transaction price, brokerage, GST and STT etc. as applicable, separately, within 24 hours of execution of trades. | Do not opt for digital contracts, if not familiar with computers. |

| 8 | Receive funds and securities / commodities on time within 24 hours from pay-out. | Do not share trading password. |

| 9 | Verify details of trades, contract notes and statement of account and approach relevant authority for any discrepancies. Verify trade details on the Exchange websites from the trade verification facility provided by the Exchanges. | Do not fall prey to fixed / guaranteed returns schemes. |

| 10 | Receive statement of accounts periodically. If opted for running account settlement, account has to be settled by the stock broker as per the option given by the client (30 or 90 days). | Do not fall prey to fraudsters sending emails and SMSs luring to trade in stocks / securities promising huge profits. |

| 11 | In case of any grievances, approach stock broker or Stock Exchange or SEBI for getting the same resolved within prescribed timelines. | Do not follow herd mentality for investments. Seek expert and professional advice for your investments. |

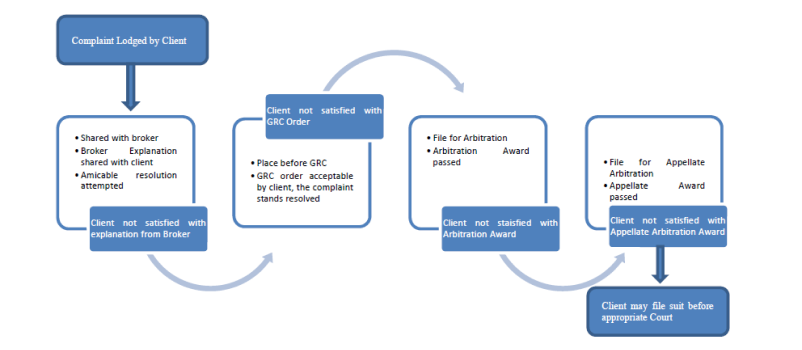

Grievance Redressal Mechanism

Level 1

Approach the Stock Broker at the designated Investor Grievance e-mail ID of the stock broker. The Stock Broker will strive to redress the grievance immediately, but not later than 30 days of the receipt of the grievance.

Level 2

Approach the Stock Exchange using the grievance mechanism mentioned at the website of the respective exchange.

Timelines for complaint resolution process at Stock Exchanges against stock brokers

| Sr. No. | Type of Activity | Timelines for activity |

|---|---|---|

| 1 | Receipt of Complaint | Day of complaint (C Day). |

| 2 | Additional information sought from the investor, if any, and provisionally forwarded to stock broker. | C + 7 Working days. |

| 3 | Registration of the complaint and forwarding to the stock broker. | C+8 Working Days i.e. T day. |

| 4 | Amicable Resolution. | T+15 Working Days. |

| 5 | Refer to Grievance Redressal Committee (GRC), in case of no amicable resolution. | T+16 Working Days. |

| 6 | Complete resolution process post GRC. | T + 30 Working Days. |

| 7 | In case where the GRC Member requires additional information, GRC order shall be completed within. | T + 45 Working Days. |

| 8 | Implementation of GRC Order. | On receipt of GRC Order, if the order is in favour of the investor, debit the funds of the stock broker. Order for debit is issued immediately or as per the directions given in GRC order. |

| 9 | In case the stock broker is aggrieved by the GRC order, will provide intention to avail arbitration | Within 7 days from receipt of order |

| 10 | If intention from stock broker is received and the GRC order amount is upto Rs.20 lakhs | Investor is eligible for interim relief from Investor Protection Fund (IPF).The interim relief will be 50% of the GRC order amount or Rs.2 lakhs whichever is less. The same shall be provided after obtaining an Undertaking from the investor. |

| 11 | Stock Broker shall file for arbitration | Within 6 months from the date of GRC recommendation |

| 12 | In case the stock broker does not file for arbitration within 6 months | The GRC order amount shall be released to the investor after adjusting the amount released as interim relief, if any. |

Handling of Investor’s claims / complaints in case of default of a Trading Member / Clearing Member (TM/CM)

Default of TM/CM

Following steps are carried out by Stock Exchange for benefit of investor, in case stock broker defaults:

- Circular is issued to inform about declaration of Stock Broker as Defaulter.

- Information of defaulter stock broker is disseminated on Stock Exchange website.

- Public Notice is issued informing declaration of a stock broker as defaulter and inviting claims within specified period.

- Intimation to clients of defaulter stock brokers via emails and SMS for facilitating lodging of claims within the specified period.

Following information is available on Stock Exchange website for information of investors:

- Norms for eligibility of claims for compensation from IPF.

- Claim form for lodging claim against defaulter stock broker.

- FAQ on processing of investors’ claims against Defaulter stock broker.

- Provision to check online status of client’s claim.

Level 3

The complaint not redressed at Stock Broker / Stock Exchange level, may be lodged with SEBI on SCORES (a web based centralized grievance redressal system of SEBI) https://scores.gov.in/scores/Welcome.html

Disclosure of Complaints

Details of business transacted by the Depository and Depository Participant (DP)

A Depository is an organization which holds securities of investors in electronic form. Depositories provide services to various market participants – Exchanges, Clearing Corporations, Depository Participants (DPs), Issuers and Investors in both primary as well as secondary markets. The depository carries out its activities through its agents which are known as Depository Participants (DP). Details available on the link https://www.cdslindia.com/DP/dplist.aspx

Description of services provided by the Depository through Depository Participants (DP) to investors

1. Basic Services

| Sr. No. | Brief about the Activity / Service | Expected Timelines for processing by the DP after receipt of proper documents |

|---|---|---|

| 1 | Dematerialization of securities | 7 days |

| 2 | Rematerialization of securities | 7 days |

| 3 | Mutual Fund Conversion/Destatementization | 5 days |

| 4 | Re-conversion/Restatementisation of Mutual fund units | 7 days |

| 5 | Transmission of securities | 7 days |

| 6 | Registering pledge request | 15 days |

| 7 | Closure of demat account | 30 days |

| 8 | Settlement Instruction | Depositories to accept physical DIS for pay-in of securities upto 4 p.m and DIS in electronic form upto 6 p.m on T+1 day |

2. Depositories provide special services like pledge, hypothecation, internet based services etc. in addition to their core services and these include

| Sr. No. | Type of Activity /Service | Brief about the Activity / Service |

|---|---|---|

| 1 | Value Added Services | Depositories also provide value added services such as a. Basic Services Demat Account (BSDA) : The facility of BSDA with limited services for eligible individuals was introduced with the objective of achieving wider financial inclusion and to encourage holding of demat accounts. No Annual Maintenance Charges (AMC) shall be levied, if the value of securities holding is upto Rs. 50,000. For value of holdings between Rs 50,001- 2,00,000, AMC not exceeding Rs 100 is chargeable. In case of debt securities, there are no AMC charges for holding value upto Rs 1,00,000 and a maximum of Rs 100 as AMC is chargeable for value of holdings between Rs 1,00,001 and Rs 2,00,000. b. Transposition cum dematerialization : In case of transposition-cum-dematerialisation, client can get securities dematerialised in the same account if the names appearing on the certificates match with the names in which the account has been opened but are in a different order. The same may be done by submitting the security certificates along with the Transposition Form and Demat Request Form. c. Linkages with Clearing System : Linkages with Clearing System for actual delivery of securities to the clearing system from the selling brokers and delivery of securities from the clearing system to the buying broker d. Distribution of cash and non-cash corporate benefits (Bonus, Rights, IPOs etc.), stock lending. |

| 2 | Consolidated Account statement (CAS) | CAS is issued 10 days from the end of the month (if there were transactions in the previous month) or half yearly(if no transactions). |

| 3 | Digitalization of services provided by the depositories | Depositories offer below technology solutions and e-facilities to their demat account holders through DPs: a. E-account opening : Account opening through digital mode, popularly known as “On-line Account opening”, wherein investor intending to open the demat account can visit DP website, fill in the required information, submit the required documents, conduct video IPV and demat account gets opened without visiting DPs office. b. Online instructions for execution : Online instructions for execution internet-enabled services like Speed-e (NSDL) & Easiest (CDSL) empower a demat account holder in managing his/her securities ‘anytime-anywhere’ in an efficient and convenient manner and submit instructions online without the need to use paper. These facilities allows Beneficial Owner (BO) to submit transfer instructions and pledge instructions including margin pledge from their demat account. The instruction facilities are also available on mobile applications through android, windows and IOS platforms. c. e-DIS / Demat Gateway : Investors can give instructions for transfer of securities through e-DIS apart from physical DIS. Here, for on-market transfer of securities, investors need to provide settlement number along with the ISIN and quantity of securities being authorized for transfer. Client shall be required to authorize each e-DIS valid for a single settlement number / settlement date, by way of OTP and PIN/password, both generated at Depositories end. Necessary risk containment measures are being adopted by Depositories in this regard. d. e-CAS facility : Consolidated Account Statements are available online and could also be accessed through mobile app to facilitate the investors to view their holdings in demat form. e. Miscellaneous services : Transaction alerts through SMS, e-locker facilities, chatbots for instantaneously responding to investor queries etc. have also been developed. |

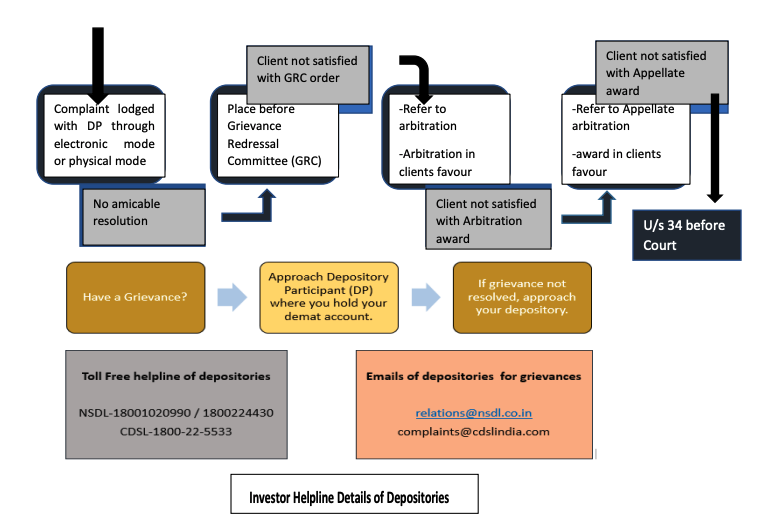

Details of Grievance Redressal Mechanism

1. The Process of investor grievance redressal

| Sr. No. | ||

|---|---|---|

| 1 | Investor Complaint/ Grievances | Investor can lodge complaint/ grievance against the Depository/DP in the following ways: a. Electronic mode - (i) SCORES (a web based centralized grievance redressal system of SEBI) (ii) Respective Depository’s web portal dedicated for the filing of compliant (iii) Emails to designated email IDs of Depository - complaints@cdslindia.com b. Offline mode : - For tracking of your grievance, we request you to submit the same online through the portal. The complaints/ grievances lodged directly with the Depository shall be resolved within 30 days |

| 2 | Investor Grievance Redressal Committee of Depository | If no amicable resolution is arrived, then the Investor has the option to refer the complaint/ grievance to the Grievance Redressal Committee (GRC) of the Depository. Upon receipt of reference, the GRC will endeavor to resolve the complaint/ grievance by hearing the parties, and examining the necessary information and documents. |

| 3 | Arbitration proceedings | The Investor may also avail the arbitration mechanism set out in the Byelaws and Business Rules/Operating Instructions of the Depository in relation to any grievance, or dispute relating to depository services. The arbitration reference shall be concluded by way of issue of an arbitral award within 4 months from the date of appointment of arbitrator(s). |

2. For the Multi-level complaint resolution mechanism available at the Depositories please refer to Complaint Resolution process at Depositories

Guidance pertaining to special circumstances related to market activities: Termination of the Depository Participant

| Sr. No. | Type of special circumstances | Timelines for the Activity/ Service |

|---|---|---|

| 1 | - Depositories to terminate the participation in case a participant no longer meets the eligibility criteria and/or any other grounds as mentioned in the bye laws like suspension of trading member by the Stock Exchanges. -Participant surrenders the participation by its own wish. | Client will have a right to transfer all its securities to any other Participant of its choice without any charges for the transfer within 30 days from the date of intimation by way of letter/email. |

Dos and Don’ts for Investors

| Sr. No. | Guidance |

|---|---|

| 1 | Always deal with a SEBI registered Depository Participant for opening a demat account. |

| 2 | Read all the documents carefully before signing them |

| 3 | Before granting Power of attorney to operate your demat account to an intermediary like Stock Broker, Portfolio Management Services (PMS) etc., carefully examine the scope and implications of powers being granted. |

| 4 | Always make payments to registered intermediary using banking channels. No payment should be made in name of employee of intermediary. |

| 5 | Accept the Delivery Instruction Slip (DIS) book from your DP only (pre-printed with a serial number along with your Client ID) and keep it in safe custody and do not sign or issue blank or partially filled DIS slips. Always mention the details like ISIN, number of securities accurately. In case of any queries, please contact your DP or broker and it should be signed by all demat account holders. Strike out any blank space on the slip and Cancellations or corrections on the DIS should be initialed or signed by all the account holder(s). Do not leave your instruction slip book with anyone else. Do not sign blank DIS as it is equivalent to a bearer cheque. |

| 6 | Inform any change in your Personal Information (for example address or Bank Account details, email ID, Mobile number) linked to your demat account in the prescribed format and obtain confirmation of updation in system |

| 7 | Mention your Mobile Number and email ID in account opening form to receive SMS alerts and regular updates directly from depository. |

| 8 | Always ensure that the mobile number and email ID linked to your demat account are the same as provided at the time of account opening/updation. |

| 9 | Do not share password of your online trading and demat account with anyone. |

| 10 | Do not share One Time Password (OTP) received from banks, brokers, etc. These are meant to be used by you only. |

| 11 | Do not share login credentials of e-facilities provided by the depositories such as e-DIS/demat gateway, SPEED-e/easiest etc. with anyone else. |

| 12 | Demat is mandatory for any transfer of securities of Listed public limited companies with few exceptions. |

| 13 | If you have any grievance in respect of your demat account, please write to designated email IDs of depositories or you may lodge the same with SEBI online at https://scores.gov.in/scores/Welcome.html |

| 14 | Keep a record of documents signed, DIS issued and account statements received. |

| 15 | As Investors you are required to verify the transaction statement carefully for all debits and credits in your account. In case of any unauthorized debit or credit, inform the DP or your respective Depository. |

| 16 | Appoint a nominee to facilitate your heirs in obtaining the securities in your demat account, on completion of the necessary procedures. |

| 17 | Register for Depository's internet based facility or download mobile app of the depository to monitor your holdings. |

| 18 | Ensure that, both, your holding and transaction statements are received periodically as instructed to your DP. You are entitled to receive a transaction statement every month if you have any transactions. |

| 19 | Do not follow herd mentality for investments. Seek expert and professional advice for your investments |

| 20 | Beware of assured/fixed returns. |

Rights of investors

- Receive a copy of KYC, copy of account opening documents.

- No minimum balance is required to be maintained in a demat account.

- No charges are payable for opening of demat accounts.

- If executed, receive a copy of Power of Attorney. However, Power of Attorney is not a mandatory requirement as per SEBI / Stock Exchanges. You have the right to revoke any authorization given at any time.

- You can open more than one demat account in the same name with single DP/ multiple DPs.

- Receive statement of accounts periodically. In case of any discrepancies in statements, take up the same with the DP immediately. If the DP does not respond, take up the matter with the Depositories.

- Pledge and /or any other interest or encumbrance can be created on demat holdings.

- Right to give standing instructions with regard to the crediting of securities in demat account.

- Investor can exercise its right to freeze/defreeze his/her demat account or specific securities / specific quantity of securities in the account, maintained with the DP.

- In case of any grievances, Investor has right to approach Participant or Depository or SEBI for getting the same resolved within prescribed timelines.

- Every eligible investor shareholder has a right to cast its vote on various resolutions proposed by the companies for which Depositories have developed an internet based ‘e-Voting’ platform.

- Receive information about charges and fees. Any charges/tariff agreed upon shall not increase unless a notice in writing of not less than thirty days is given to the Investor.

Responsibilities of Investors

- Deal with a SEBI registered DP for opening demat account, KYC and Depository activities.

- Provide complete documents for account opening and KYC (Know Your Client). Fill all the required details in Account Opening Form / KYC form in own handwriting and cancel out the blanks.

- Read all documents and conditions being agreed before signing the account opening form.

- Accept the Delivery Instruction Slip (DIS) book from DP only (preprinted with a serial number along with client ID) and keep it in safe custody and do not sign or issue blank or partially filled DIS.

- Always mention the details like ISIN, number of securities accurately

- Inform any change in information linked to demat account and obtain confirmation of updation in the system.

- Regularly verify balances and demat statement and reconcile with trades / transactions.

- Appoint nominee(s) to facilitate heirs in obtaining the securities in their demat account.

- Do not fall prey to fraudsters sending emails and SMSs luring to trade in stocks / securities promising huge profits

Disclosure of Complaints

Details of business transacted by the Research Analyst with respect to the investors

- To publish research report based on the research activities of the RA.

- To provide an independent unbiased view on securities.

- To offer unbiased recommendation, disclosing the financial interests in recommended securities.

- To provide research recommendation, based on analysis of publicly available information and known observations.

- To conduct audit annually.

Details of services provided to investors (No Indicative Timelines)

- Onboarding of Clients

- Disclosure to Clients : To distribute research reports and recommendations to the clients without discrimination.

- To maintain confidentiality w.r.t publication of the research report until made available in the public domain.

Details of grievance redressal mechanism and how to access it

In case of any grievance / complaint, an investor should approach the concerned research analyst and shall ensure that the grievance is resolved within 30 days.

If the investor’s complaint is not redressed satisfactorily, one may lodge a complaint with SEBI on SEBI’s SCORES portal which is a centralized web based complaints redressal system. SEBI takes up the complaints registered via SCORES with the concerned intermediary for timely redressal. SCORES facilitates tracking the status of the complaint.

With regard to physical complaints, investors may send their complaints to: Office of Investor Assistance and Education, Securities and Exchange Board of India, SEBI Bhavan. Plot No. C4-A, ‘G’ Block, Bandra-Kurla Complex, Bandra (E), Mumbai – 400 051.

Expectations from the investors (Responsibilities of investors)

Do’s

- Always deal with SEBI registered Research Analyst.

- Ensure that the Research Analyst has a valid registration certificate.

- Check for SEBI registration number.

- Please refer to the list of all SEBI registered Research Analysts which is available on SEBI website in the following link:(https://www.sebi.gov.in/sebiweb/other/OtherAction.do?doRecognisedFpi=yes &intmId=14)

- Always pay attention towards disclosures made in the research reports before investing.

- Pay your Research Analyst through banking channels only and maintain duly signed receipts mentioning the details of your payments.

- Before buying securities or applying in public offer, check for the research recommendation provided by your research Analyst.

- Ask all relevant questions and clear your doubts with your Research Analyst before acting on the recommendation.

- Inform SEBI about Research Analyst offering assured or guaranteed returns.

Don’ts

- Do not provide funds for investment to the Research Analyst.

- Don’t fall prey to luring advertisements or market rumours.

- Do not get attracted to limited period discount or other incentive, gifts, etc. offered by Research Analyst.

- Do not share login credentials and password of your trading and demat accounts with the Research Analyst.